How is the Common Domain Model standardising post-trade?

The complexity involved in trade processing has, for years, put market participants under considerable strain. Navigating this landscape has proved increasingly difficult due to the number of overlapping requirements introduced in the past decade, forcing firms to constantly recalibrate their workflows.

by Leo Labeis, CEO, REGnosys

The Common Domain Model (CDM) has emerged as one of the leading technologies designed to tackle this problem. The CDM is an open-source, human-readable and machine-executable data model for trade products and processes. It creates a digital representation of contracts and events across the lifecycle of financial transactions while supporting the conversion to and from existing messaging standards. This allows market participants to achieve consistency in the interpretation and implementation of post-trade requirements.

Despite emerging as an important tool in achieving greater cohesiveness in trade processing, one of the most frequently levelled criticisms against the CDM is that it is a solution looking for a problem.

This criticism, however, misunderstands the very purpose that the CDM was created to serve. The CDM has always been the analysis of a problem before being the outline of a solution. Not making the CDM a solution to a specific problem is precisely what allows it to tackle the inefficiencies it was designed to unlock.

The CDM is not – and shouldn’t be – a solution

Solutions exist at every point of the trade lifecycle, from matching to reporting to collateral management. Some of these solutions are widely adopted by the industry, and in most cases, organisations can choose between multiple available solutions.

The problem that persists across the post-trade landscape is not about a lack of solutions – it’s about a lack of interoperability. New mandates introduced after the 2008 global financial crisis, such as clearing, reporting or margin requirements, have led to a proliferation of new processes and fragmented approaches globally. ISDA itself has recognised that the “industry’s limited resources are not always focussed on developing and delivering common solutions.”

So, the need is not for another solution – the industry already has many of these. This is exactly why the CDM is not a solution and never should be. In this scenario – if the CDM was crafted to be a solution to a specific pain point in the trade lifecycle – the model would be customised to that specific use case rather than promoting consistency and robustness.

The industry’s current approach to trade confirmation illustrates this pitfall. This process usually classifies products upfront. As a result, most downstream trade processes, for instance, clearing or reporting, are engineered based on product types, even though they may not be the relevant classification for those processes.

Before we know it, the CDM would have perpetuated the very problem that current solutions suffer from – a lack of interoperability at different points in the trade lifecycle.

If the CDM isn’t a solution, then what is it?

What post-trade infrastructure needs is the development of common foundations for the processes, behaviours and data elements of the trade lifecycle. The CDM was created to meet this demand.

That the CDM is “coded” explains why it is often mistaken for a solution, based on the assumption that code equates to a solution. It is more accurate to think of the CDM as a library distributed in multiple languages and accompanied by visual representations. That code library is directly usable in solution implementations but critically remains independent of any particular solution or system.

Digital Regulatory Reporting (DRR) – an initiative initially championed by ISDA – provides the best illustration of this separation in action. DRR delivers a standardised, coded interpretation of the trade reporting rules using CDM-based data to represent the transaction inputs.

Importantly, DRR is only an application of the CDM. It does not directly interfere with the CDM, so the latter remains free of any reporting perspective. For instance, the processing of transaction inputs with static referential data, often jurisdiction-specific, is part of DRR but not of the CDM.

Keeping the CDM as a genuine common denominator is key to ensuring its status as a pivot between different trade processes without being encumbered by any particular one.

Looking ahead

The CDM has enormous potential to foster greater standardisation across the post-trade landscape. It can work in a complementary way to any other data standards – including FIX, FpML or ISO 20022 – and can be integrated into the internal systems of market participants, enabling data to be interpreted consistently across the board.

To realise this potential, it is vital for the industry to fully understand that not making the CDM a solution to a specific problem is what allows it to achieve this harmonisation. In doing so, firms can begin to implement more innovative and strategic approaches to data management.

Modern Digital Banking Experiences Built on Cloud

The banking industry, among other industries, has witnessed a massive shift in customer behaviour with the growing use of digital channels, resulting in an increased volume of data banks manage. This data sits at the heart of the digital banking trend to provide superior, personalised, and highly secured service.

By Kalpesh Mistry, Senior Vice President – BFS, ITC Infotech

Cloud technology is becoming instrumental in reshaping digital banking services, making banking more seamless and convenient for customers. Over the last 5 years, banks have invested significant money in implementing omnichannel solutions powered by microservice-based architecture on a hybrid cloud environment with limited cloud adoption for their core banking and data solutions.

Many banks have embraced a lift and shift strategy to move some banking applications onto the cloud-virtualised platform to manage the regulatory expectation for their old data centre and reduce the Infra cost. But the establishment of full-scale cloud services like cloud-based data analytics and the transition of legacy core banking solutions to the cloud, is still in the early stage. On the other side, FinTechs have quickly identified the growing demand for digital banking and are the early adopters of establishing full digital banking on the cloud.

As most banks move towards Banking-as-a-Service on the cloud from their partially modernised banking solution implemented on an on-premise/hybrid cloud environment, it is essential to understand the possible challenges that could stand in the way of the bank modernisation journey.

Challenges Faced while Digitizing Banking on the Cloud

According to a study by Bain&Co, 80% of CEOs believe they deliver a superior customer experience, while only 8% of customers agree. This disagreement means that the banking impact on customers is heavily misunderstood.

- Customers’ expectations are rising quickly as transaction volumes, and associated revenues are shifting to challenger banks/FinTechs in the market. Banks must reinvent themselves with better digital banking tools to deliver a personalised experience. FinTech startups leverage AI/ML-based solutions to meet customers’ needs at a granular, tailored level. Their key focus is improving the delivery of financial services with a seamless user experience and simplifying the banking experience for customers.

- The security infrastructure and firewall are continuously upgraded to protect banks from cyber-attacks and various other security threats. However, we continue to see that security is compromised, which has resulted in penalties from regulators and impacted the customers’ trust in the banks. While a bank is moving its complete banking service and growing customer data to the cloud, it is important for the bank to redefine its IT security ecosystem and the resilience strategy along with the chosen cloud partners.

- Innovation and modernisation are imperative but require investment in people’s skill transformation. Lack of cloud technical expertise will affect cloud and product implementation. Creating a product or solution from scratch could drain time, money, and resources, along with siloed processes and slow decision cycles, which could delay time-to-market. Many banks lack the internal capabilities to innovate secured digital banking on the cloud.

- Cultural resistance – rigidity in the internal customers’ mindset must be transitioned to an agile one for a smoother transition to digital banking operations. The cultural resistance is linked to the bank’s investment in improving internal cloud competency.

Banks are adopting the strategy outlined below to accelerate digital banking on the cloud to maximise ROI

- SaaS: a cloud-based Banking-as-a-Service solution

Build a tech stack of best-of-breed, Cloud-native technologies that allow the bank to swap components in and out as needed. A ‘”plug and play’ SaaS applications approach can help banks minimise time-to-value and time-to-market. SaaS Cloud solutions stand out from on-prem solutions due to their flexible pricing and subscription model, which delivers easy scalability while meeting the ongoing needs of an enterprise.

- Open banking is considered at the heart of digital banking on the cloud strategy

According to a survey by Open Banking Org, 10–11% of digitally-enabled consumers are now estimated to be active users of at least one open banking service. This is expected to grow exponentially in the next 3 years. Open banking cloud architecture enables the data and services from various third-party sources, uses machine learning to generate granular insights, and then integrates data into banks’ channels in real time. Cloud has become one of the main allies in creating an open API secure open banking ecosystem to provide personalised digital banking solutions to improve the customer experience.

- Collaborative engagement with a ‘Hyperscaler’ cloud provider

Proactive engagement with Hyperscaler cloud providers assesses the current technology ecosystem and defines the plan to develop the same. Hyperscalers provide various support, including technology assessment, future roadmap definition, POC, and training. Collaborative engagement with hyperscalers is crucial while the bank is in the early stage of development.

- Internal team onboarding

Employees and internal audiences can individually benefit from Banking-as-a-Service on the cloud. The bank’s management must leverage effective communication media to onboard employees on the cloud journey through newsletters, web pages, and regular town hall meetings to ensure awareness of a cloud strategy is present across the bank thus ensuring a smooth, uniform transition with fewer bottlenecks.

- Internal resource competency

Getting on the cloud is a journey, not a one-time exercise. While the IT team focuses on the technology roadmap and implementation, the HR and Training team must be empowered to define a roadmap for the upskilling of resources. The organisation also needs to leverage the training investment of the Hyperscalers and IT partners effectively. The bank must define the training goals jointly with its partners before beginning the cloud journey, and progress must be measured and governed by the executive steering committee.

Cloud technologies provide a best-in-the-class secured environment for a bank to fast-track its digital bank cloud strategy to deliver the increasing demands of digitisation. The cloud strategy has been utilised so far for its scalability and cost optimisation. But the way forward for a successful bank is to leverage hyperscaler nextgen investment in various cloud components such as data analytics and insight, Blockchain and more, to deliver higher value to its customers.

Why banking CIOs should embrace Open Banking

The first release of the API specifications for Open Banking was five years ago. At the time, I recall that many people in the banking sector didn’t see much value in it. In fact, many saw it as a potential impediment to their job.

by Martin Gaffney, Vice President EMEA, Yugabyte

Five years on, it is clear that those fears were unfounded. In May 2022 alone, UK businesses and consumers made five million open banking-driven payments. The UK open banking community made a record 1 billion API calls in the same month.

So, Open Banking ended up being a pleasant surprise rather than a restrictive move by the regulators. It opened up opportunities and showed that having to work with APIs is not a constraint but in fact, quite the opposite.

It’s taken the market a while to see that. 20 years ago, every management consultant in the sector was recommending disintermediation—the idea that you needed to own and run your own supply chain to reduce complexity.

That was still the driver when big banks started to go online: they built their own websites, their own banking applications, their own mobile solutions—all with the aim of owning everything from cell phone banking to the back end.

In practice, this actually added complexity. It meant that when a bank decided to write a web page, it had to be set to talk to an application server, which talked to its internal database, which was deployed on its on-prem server farm. It was all the bank’s responsibility, from start to finish. As a result, the organisation may have needed multiple developers with various overlapping skill sets working on this full tech stack.

But now, thanks to Open Banking and APIs, to be a serious player in banking, you must be adept at exposing and consuming APIs. To do this, you need to have the right architectures, skills, and tools in place to support this modern approach to software development.

I’d go so far as to say that we are now entering the era of ‘de-disintermediation’—as what Open Banking really means is that the bank is no longer permitted to lock anybody out, and we all need to work in a different and ‘more open’ way.

Welcome to the new de-disintermediated financial services IT world

Consumers see this on their mobile banking app, which is now full of friendly questions about whether you want to hook in another of your accounts and bring them all together in one place. Personally, I love this: it makes sense to me as a digital citizen, as a capitalist, and as a shopper.

I also like all the new businesses that Open Banking and de-disintermediation have allowed to flourish. Embedded banking is why Klarna can exist, where Buy Now, Pay Later comes in; it’s how many new payment brands work and has contributed to the major upsurge in innovative FinTech companies.

I am also seeing extremely positive moves at the tech and architecture end of the ecosystem. To do Open Banking, you must build your app in a way that allows somebody else to come in at the application server layer. You must also allow that other party’s application server to talk to other application servers, all of which have databases at the back end.

This is where the API has come into its own. IT people in progressive financial services companies welcome the fact that application programming interfaces (a technology in search of a business case for too long) make it so easy for two pieces of software to talk to each other by a contract.

Even better, the contract obliges everyone in the chain to play fair. For example, if I’m building an application that allows someone to access their bank account and returns their statements or their latest transactions, I have to publish what the API call is to get them. You must give me live session credentials, you must give me what I need, and this all happens in one agreed format–(typically) JSON, JavaScript Object Notation.

App modernisation + liberalisation = good times ahead

The reality is that the people who will succeed in an Open Banking/de-disintermediated/API-centric world are the people who build their processes, skill sets, tools, and architectures in a way that embraces this way of working. Delivering on this new approach will unlock business value.

This also means the end of huge monolithic banking applications. Now, developers can break the front off and replace the proprietary apps with APIs. This means you can more effectively outsource the value that your back end supplies, even if that’s still some monolithic mainframe app in your data centre. APIs allow you to expose it to the web and give chosen partners access to it, adding value for you.

This way of working is possibly better known to you as microservices architectures on the Cloud. Two separate tech and business development threads mesh here: one is app modernisation and the other is the general acceptance that microservices architectures are good for exploiting cloud architecture. A drive to allow more competition in the market in the shape of Open Banking has shown the API to be the best way to both comply with the regulations and to embrace that great new architecture.

There is also a database aspect here because as soon as you start the road to de-disintermediation by breaking your big banking systems up, you’re also breaking your data up. You can’t just stick with your tried and true (if rather expensive) monolithic database on the back end. Even if you did, you’d still have the ongoing problem that on-prem monolithic proprietary databases never match well with cloud-based microservices, which aim to bring everything data processing as close to the customer as possible around the world.

Given this, you can’t really have all your data sitting in a great data barn somewhere outside London. You’ll need to move to the modern data layer, an intrinsic part of this microservices architecture.

How about ending the banking IT ‘technical debt’ issue

It’s time, then, to thank the inventors of Open Banking, who weren’t (as feared) awkward people who wanted to stop you from doing stuff. You should see them instead as benefactors who’ve unlocked the door for you as a banking CIO to access a massive amount of innovation and business value in a supply chain you no longer need to 100% own.

If you embrace this, much of your day-to-day work, which is really just technical debt and patching up the work your predecessor did when John Major was PM, can go away. You can rip it up and rewrite it, turn it into an API, and let somebody else put a front end on it.

To me, the benefit of Open Banking is very clear. However, if you don’t see this as an opportunity, and consider it just another IT burden, maybe you need to ask how much of a contribution to the business you’re really making.

Why Online Payments Are the Next Big Thing in eCommerce Innovation

Industry players are on a mission to differentiate themselves, while merchants and consumers are demanding innovative ways to pay for what they buy. A seamless payment experience is becoming more and more important to consumers and therefore merchants as eCommerce continues to be as competitive as ever.

by Ed Whitehead, Managing Director EMEA for Signifyd

Guided by the industry leaders that participated in Signifyd’s FLOW Summit 2022, featuring nearly 300 eCommerce leaders discussing the current state and future vision, we delve into what the innovation in online payments has in store for all industry players.

Industry analysts are seeing the potential of payments for revenue optimisation and seizing on the opportunity. The innovation and excitement of online payments fit just right in the new eCommerce landscape. With customers demanding increased flexibility, user-friendly payment innovation is now an important influencer in eCommerce consumer behaviours.

According to research by S&P Global Market Intelligence, merchants are missing out on $16.3 billion in revenue annually due to false declines and $20.1 billion due to customers’ preferred payment methods not being accepted on retailers’ sites.

Merchants can benefit from a best-in-class fraud solution to help them optimise payments and capitalise on their revenue. The opportunity lies in the middle of the shopping journey. While customer acquisition costs are increasing, fulfillment costs will continue rising, with customers demanding faster and more personalised delivery. The opportunity for value improvement lies in improving user experience while optimising checkout and payments.

Ending the payments’ path to commoditisation

The heart of the shopping journey is essentially the shopping cart. This is a ‘make or break moment for merchants. Whether a customer continues to the final stage of their shopping journey or not will determine the merchant’s revenue.

Samsung Chief Digital Officer Kal Raman and his team adopted a “return on shopping cart” metric. Incorporating big data, it tracks what happens to orders after buyers hit the buy button and place items in carts. It aims to gather insight into how many of them convert, and what happens to those that don’t, and spot opportunities to save those customers for a lifetime.

For a bigger advantage in retaining customers, PSPs need to provide competitive packages of products that offer merchants value extending to their customers.

Nicole Jass, FIS senior vice president of growth solutions product, commented: “The biggest thing in payments is that payments are getting commoditized. The payments piece is like the utility company. We’re the electricity that you just accept comes to your house.”

What FIS, which includes payments provider Worldpay, is doing to break out of the mold is launching its Guaranteed Payments. In partnership with Signifyd which provides a very robust payment fraud solution, Guaranteed Payments will be integrated into the payment stack to provide merchants with higher and guaranteed approvals – a huge challenge and pain point for merchants.

As a first in the industry, this type of innovative collaboration will stop payments from being commoditized. It changes the eCommerce game rules from fighting fraud to approving good orders. That opens doors for customers to try new payment plans without the fear of fraud.

One of FIS’ customers already saw great results from this innovation in online payments. Its approval rate increased by 7%, which turned into $8 million. These are topline results. The hope is that this process will also affect other players, such as issuers, who will authorise more orders when they see they are receiving better quality orders.

With the realisation of how online payments can be optimised, PSPs, merchants, and customers are seizing the opportunity to maximise revenue and provide a seamless customer journey. Online payments are a gold mine for up-levelling the eCommerce game and stepping into the new era of eCommerce innovation.

Pan-African upgrade for Access Bank’s core systems

Headquartered in Lagos, Nigeria, Access Bank is one of the largest and most recognised financial institutions in Africa with operations across 11 countries. The bank called on the services of trusted Oracle Partner, Finonyx Software Solutions for a major upgrade programme across all its subsidiaries

-Robin Amlôt

-Managing Editor, IBS Intelligence

The project was an upgrade to the core banking solution to Oracle FLEXCUBE v12.0.2 at Access Bank subsidiaries in 10 countries. The solution had already been deployed at the bank’s headquarters in Lagos, Nigeria. The project covered:

- Upgrades from legacy versions of FLEXCUBE in 6 countries: DR Congo, Gambia, Ghana, Rwanda, Sierra Leone and Zambia.

- The merger of newly acquired Cavmont Bank in Zambia which required migration from third party applications and integration with the FLEXCUBE.

- A further 2 banks required migration from third party applications and integration with the FLEXCUBE – Trasnational Bank in Kenya and Gro Bank in South Africa.

- Greenfield implementations in Guinea and Cameroon.

Ade Bajomo (AB), Executive Director – IT & Operations at Access Bank, explains the business drivers behind the bank’s decision to initiate the project:

AB: “Access Bank has been on an expansion path over the years and has 10 subsidiaries in 10 African countries and is further expanding. The backend applications used across the subsidiaries were dissimilar – multiple versions of the software, inadequate production support from OEM for tech stack and core banking platform due to the obsolescence of application version, independent satellite applications, lack of standard modern interfaceability between applications, etc.; these created multiple challenges. Technology obsolescence at certain areas, lack of harmony and group level consolidation, inability to launch new products and bring them to market quickly.”

What was the proposed solution?

AB: “Our management and technology review committee decided on a two-phase technology upgrade. Phase 1 to harmonise the solutions across all the subsidiaries to Oracle Flexcube 12.0.2 which is used at the HQ in Lagos, Nigeria. In Phase 2 all subsidiaries and the HQ would upgrade to the latest version of Oracle FLEXCUBE 14.x. Since Access Bank has been using the FLEXCUBE core banking system and the primary goal of the program was solution harmonization – Oracle FLEXCUBE 12.0.2 was an automatic choice.”

How was Finonyx chosen as the partner?

AB: “Post finalisation of the upgrade programme and project plan, Access wanted to bring on board an implementation partner to deliver the program. Finonyx was one of the vendors that met the rigorous evaluation and due-diligence criteria that were set up. Access Bank has associated with Finonyx in one of our earlier successful projects; the efforts and commitment shown by the team steered our decision in favour of Finonyx.”

N V Subba Reddy (NVSR), Managing Director and CEO of Finonyx Software Solutions added: “Finonyx was proud to be associated with Access Bank. In 2019 Access Bank acquired Diamond Bank Limited, Nigeria, Finonyx was the delivery partner for the merger project, and we were able to demonstrate our commitment and quality of delivery. This was a reassurance for the Access Bank management to select Finonyx over competing vendors for this ambitious, multi-country implementation programme.”

What was the implementation process?

NVSR: “The implementation process involved: Product Walkthrough, Product & Interface Harmonisation, Core User Training, Parameterisation, Data migrations, build interfaces between FLEXCUBE and 3rd party systems in each country (regulatory/non-regulatory), SIT, UAT, business simulations and live cutover.

“Given the number of countries and dissimilarity of systems, a stream approach was followed which significantly helped the synergies between the teams at the bank and Finonyx. This also meant that our teams were organised and synchronised for each of these project activities. Our teams could complete a project activity in one country and move on to execute the similar activity at the next country with a precision that simulated an assembly line.

“For instance, the infrastructure team would complete the installation and configuration in Country A, move to Country B and then to C and so on. This was followed by the PWT and training teams, Parameterisation team etc. The same approach was followed across all sites and at 8 countries the applications are live.”

How was the project affected by the pandemic?

NVSR: “We had our share of challenges because of the pandemic. The project was initiated around the first wave of the pandemic due to which we had to take a step back and re-evaluate our plans. The traditional model of onsite implementation was not possible. Over multiple discussion with the team from Access Bank, an offshore delivery model was agreed upon. Effective communication and a robust governance process were formulated and implemented to ensure that the project remained on course to meet the timelines set for country specific go-lives.

“Access bank is on an aggressive technology transformation journey, the first step towards this is the system standardisation across subsidiaries. This required a time-bound project plan and a team that has the solution expertise and regional understanding. We are appreciative of the efforts put forward by the Finonyx Team in ensuring success of this project. Our decision to onboard Finonyx as the strategic partner stands validated.” Ade Bajomo, Executive Director – IT & Operations, Access Bank Plc

“Project participants were affected by Covid-19 infections. However, alternate resource back-up plans were in place to ensure no/minimal disruptions in the execution of programme activities. All challenges, logistical, operational, technical, and managerial, were overcome by the delivery team alongside the creation of an implementation command centre for seamless execution.”

How was the implementation managed by the bank?

AB: “For Access Bank, this is a key programme and a critical element in our technology road map. We had to ensure a conflict free project plan and meet the timelines set towards completion of the project. As a first step – a robust implementation structure and a command centre headed by me as Executive Director was set up in Lagos – the team included the IT, business and operations departments full time at the HQ and the local IT and business teams in the respective countries. The team from Finonyx was aligned to our project team structure. This comprehensive delivery structure involving IT, business and operations teams and a meticulous governance process in the programme plan were instrumental in the overall programme success.

“With this structure in place, the majority of the project was delivered remotely and necessitated only minimal travel for consultants to the local sites. Consultants were required to be onsite only for countries with larger data volumes and the complexity of the sites (interfaces/non-FLEXCUBE legacy application, etc.) around the time of go-lives.

“Currently the solution is live at 8 countries and the final 2 sites are on-course to go-live by end of August and September 2022, respectively.”

What benefits have accrued to the bank because of this implementation?

AB:

- “Standardisation of FLEXCUBE version, business products, third-party interfaces and services across all 10 countries.

- Introduction of Universal Banking System as against 2 separate applications for retail and corporate businesses.

- Standardisation of operating procedures across subsidiaries.

- Launch of new business products / applications to customers of select subsidiaries.

- Centralised Regional Disaster Recovery Data Centre in Lagos for all countries in addition to in-country primary Disaster Recovery Data Centres.

- MIS consolidations have become much easier at the group level daily.

- Significant reduction in the overall programme budget, IT support and management costs

- Increased synergy between subsidiaries and HQ for new business ideas and post-live issues resolution.”

The new UK immigration landscape: Here is what FinTechs need to think about when recruiting talent

For a long time recruitment in the FinTech sector was relatively straightforward. Businesses could draw on talent already living and working in the UK, as well as nationals from any of the 27 EU countries, Norway, Iceland, Liechtenstein (the 3 EEA countries) and Switzerland. These potential employees did not require any specific permission to start living and working in the UK – no entry visa or work permit was necessary.

by Denise Osterwald, Senior Solicitor, Gherson Solicitors LLP

This all changed on 1 January 2021, the day the UK’s exit from the EU took effect. In addition, the UK authorities used Brexit as a catalyst to overhaul large parts of the immigration system that had been in place, in one way or another, since 2008. The changes were significant and meant that businesses now had to contend with a much smaller candidate pool as EU, EEA and Swiss nationals no longer had the ability to take up work immediately. At the same time, they had to get to grips with a new immigration system that applied to all candidates who were not British citizens or had already settled in the UK.

FinTech businesses are known to be flexible, nimble and quick to exploit gaps in the market. They are well placed to think ‘outside the box’ when it comes to attracting talent in the new immigration landscape. This can be, for example, by establishing direct relationships with colleges and universities in the UK and overseas, so they can recruit directly from the graduate pool without running the risk of losing talent on the open market. It can also include offering more or new apprenticeships in order to invest in growing talent in-house, for example. Whatever happens, they will need to get used to exploiting new avenues when it comes to finding talent.

FinTech firms also tend to be lean in terms of organisational structure, which has traditionally allowed them to be faster than their more cumbersome long-established counterparts when it comes to recruiting talent. Yet they are now forced to factor significant immigration costs as well as much longer timelines into their talent recruitment processes. They will also now need someone in the business who can administer the additional bureaucracy that comes with the new immigration system. Getting it wrong can have significant repercussions for the business.

UK immigration tends to be more complex and costly than many other jurisdictions. Work visas can cost several thousand pounds, depending on how many people apply (does your preferred candidate have family who will also need to relocate?) and for how long (anything up to five years).

Therefore, offering support to new recruits with this process has become a unique selling point for businesses vying for a comparatively small number of tech talent worldwide. The better the support, from a process as well as a financial perspective, the more likely they are to attract those who have the skills but not necessarily the means or knowledge to obtain UK work visas.

This means, of course, that the business will have to be able to sponsor work visas for their new employees. Some candidates may qualify for personal visas (such as visas based on having a British partner or having British ancestors), but it is likely that the vast majority of recruits will need sponsored work visas.

Most businesses will not have needed to engage with the UK’s points-based immigration system (PBS) before, or obtain a UK sponsor licence from the authorities, because they were able to fill their vacancies with candidates who did not require a visa. As this is no longer the case, it is advisable to obtain this licence as soon as possible so that the business is not caught on the back foot if it finds a person they would like to recruit but who needs a visa.

The process of getting a sponsor licence is not entirely straightforward. It takes time to compile the necessary documents, and then time for the UK authorities (the Home Office) to process the application. Overall, the minimum timeframe is in the region of 10-12 weeks. However, it can be significantly longer if the Home Office decides to visit the business’ premises to understand how they will comply with their sponsor duties were a licence to be granted. The duties are strict and affect the administration of the licence as well as the processes and procedures in place to ensure migrants on visas are monitored whilst employed. Small businesses will need to pay £536 for a licence, and large business £1,476. There is a way to speed up the process for an additional fee of £500, but it is not easy to obtain such a priority processing spot. If successful, the licence could be approved in around 10 working days.

Once the licence has been granted, the business can apply for a work visa. There are a number of different visas available, the most common being the Skilled Worker visa. The advantage of this visa compared to other work permits is that it can be applied for five years and can lead to indefinite leave to remain in the UK at the end of the five years (and then to British citizenship if desired). As already noted, UK visa applications tend to be more expensive than those in other countries, and the costs of a Skilled Worker application can range from £5,500 for a single applicant to around £10,000 for the main applicant, spouse and child. If an immigration adviser is engaged to assist with the sponsor licence and visa applications, their professional fees will need to be added to the above government fees.

What is clear about the new UK immigration landscape is that nearly every business now needs to engage with it and figure out how to make the support they offer to candidates a USP. They should also consider obtaining a sponsor licence because, eventually, they will want to recruit a candidate who will need a work visa. Given the complexity and potential pitfalls of navigating the UK’s immigration system, it is also advisable to think about engaging an immigration services provider who can support the organisation in obtaining and administering the sponsor licence and in guiding the business and its new employees through the visa application process.

How banks can benefit from Conversational AI in practice

The Covid-19 pandemic accelerated the trend of customers opting to use an app on their smartphone instead of visiting their local branch. British market research institute Juniper Research estimates that in 2026, around 3.6 billion bank customers worldwide will prefer to communicate with their provider digitally, up from 2.4 billion in 2020.

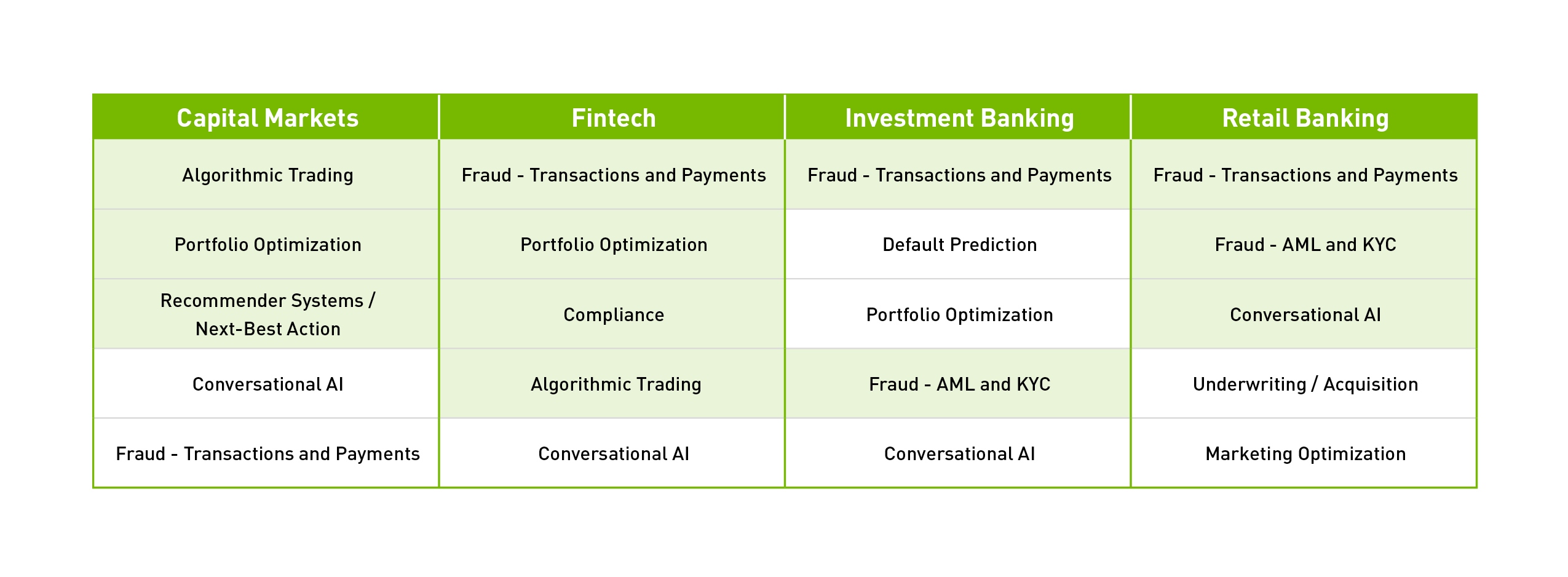

by Dr Jochen Papenbrock, Head of Financial Technology, NVIDIA EMEA

Artificial intelligence (AI) is establishing itself in the financial sector in areas like risk analysis and portfolio management. But customer care can also benefit from AI, or more precisely from Conversational AI, not just the business. The crucial prerequisite is that the appropriate AI solutions are used for each use case.

What is Conversational AI?

Conversational AI is the application of Machine Learning (ML) to allow humans to interact naturally with devices, machines, and computers using their own speech. As a person speaks, the device works to understand and find the best answer with its own natural-sounding speech. Conversational AI enables customers to interact with their bank via chatbots, voice assistants and voice input.

It is important that the system can answer questions within 300 milliseconds, as longer intervals are perceived as annoying by humans. But this requirement poses a challenge for Conversational AI applications: speed of answers can come at the expense of accuracy, but slow response times can reduce customer satisfaction. Similar to human-to-human communication, the question-answer process has to be fast, accurate, and contextual.

Other potential hurdles for an AI instance are technical terms, ambiguous questions, and colloquial and everyday language or phrases. To overcome challenges like these, Conversational AI uses complex Natural Language Processing (NLP) models and elaborate training procedures, usually with billions of different parameters. Training the models requires high-performance computers with powerful Graphics Processing Units (GPUs).

One of the challenges of Conversational AI is that banks and financial service providers, especially those that operate globally, need to maintain NLP models for multiple languages.

Currently, NLP models are primarily available in English. Fortunately, models can be translated into other languages with minimal effort, so it is not necessary to develop language-specific models completely from scratch.

More computing power required

Conversational AI application developers in the financial sector face another challenge: NLP models are becoming increasingly complex and the number of data sets used to train them is rising. Soon, NLP models will comprise several trillion parameters. But this complexity comes for good reason.

More training data increases the accuracy and performance of models and applications, and large models can be more easily adapted to different tasks at a lower cost. This means application developers will need GPUs with significantly higher computing power and a larger working memory for training extensive, local language models.

What are the benefits?

While using AI and ML in financial services is ground-breaking, what ultimately matters is the benefits these technologies bring.

An important advantage of Conversational AI is improved customer service through applications such as chatbots and voice assistants. Routine queries such as, “I lost my credit card. How can I have it blocked?” can be answered faster, more efficiently, at any time, and without the involvement of a staff member.

One AI instance can process thousands of queries like the above in parallel and answer them in seconds. Customers could check account balances or transactions, change passwords and PINs, and pay bills quickly and easily.

Conversational AI can also be used on the front lines of defence against fraud attempts by identifying and preventing suspicious account movements or putting a stop to digital identity theft by analyzing the caller’s voice pattern.

AI and advisors hand in hand

A combined approach is also an option, where both the AI system and a bank advisor are involved. For example, a customer who needs a mortgage can use Conversational AI to find out a bank’s offers and then clarify specific details with a loan specialist who has access to all previous communications. Should the customer request offer documents, either the AI system or advisor can provide them via smartphone, notebook, or stationary computer, along with a summary of the consultation.

By implementing AI in this way, banks have the opportunity to address more customers and prospects in a targeted manner with less time expenditure.

AI is a high priority for financial firms

When it comes to leveraging the full potential of AI solutions, European banks are still far behind US banks, according to a study by Bain & Company.

But European banks have plans for the coming years. The State of AI in Financial Services report by NVIDIA shows that banks, fintechs and financial service providers are intensively engaged with AI, especially Conversational AI. According to the study, 28% of companies in the financial sector want to invest in the development and implementation of Conversational AI solutions in 2022 – more than three times as many as in 2021. This puts Conversational AI in second place in the ranking of the most important applications for AI, behind AI-based solutions designed to prevent fraudulent activities.

What’s next?

With Conversational AI, banks and financial service providers can take customer experience to a new level. Especially for those who have grown up with the internet, social media and online, this next generation of customers expects their banks to take the next step and further optimize their service with the help of technologies like AI.

Regulation vs Collaboration: How to encourage innovation in financial services

The financial services industry is facing a time of considerable change. During the pandemic, financial services organisations were forced to become digital entities virtually overnight. The acceleration of initiatives has led to significant questions about how best to encourage innovation within the industry while protecting consumers and promoting financial inclusion.

by Hans Tesselaar, Executive Director at BIAN

Enter the proposed Financial Services and Markets Bill, introduced by the UK government to drive innovation across the financial services industry, focused on supporting consumers through digital change. The bill is to replace existing EU regulations following Brexit, aiming to support the UK government’s vision for an “open, green and technologically advanced sector that is globally competitive”.

While introducing the bill is a significant step forward for bringing financial services front-and-centre in the UK, how does regulation support innovation in practice?

A balancing act

The Financial Services and Markets Bill aims to harness the opportunities of innovative technologies in financial services while bolstering the competitiveness of UK markets and promoting the effective use of capital. Banks need to remember, however, that when looking to adopt new technology and innovate, the needs of all consumers must be considered.

As banks accelerate digital transformation initiatives, consumers who prefer more traditional and manual banking methods, such as banking at branches and cash payments, can easily be forgotten. A recent ruling from the FCA means that banks and building societies need to assess the impact of changes to their services. This comes after the FCA warned that the industry is “not currently doing enough to properly understand the impact of these changes”. The regulator can now issue fines to banks that don’t consider access to cash and branches.

The introduction of new legislation and guidance from the regulator is promising but the industry must strike a balancing act to transform for the future while also ensuring it is catering to all consumers, no matter their preferences.

Risk and reward

There is also a commercial motivation for introducing the Bill. The government wants to make the UK the financial, technological and crypto hub of the world, following in the footsteps of the US and moving away from the EU.

One way it plans to achieve this is to implement the outcomes of the Future Regulatory Framework (FRF) Review created to reflect the UK’s new position outside the EU. The risk is that the UK could isolate itself from its close neighbours. There is a wealth of industry surrounding the UK, and independent regulations could cause leading European Banks to look for business elsewhere due to the proposed red tape, stunting innovation.

On the other hand, countries such as Canada and Australia look to the UK as an example and becoming more connected with them could open new possibilities. Instead of concentrating solely on the UK, the value of the Bill to the industry would increase if the government looked to connect and encourage more business with different markets – and then the UK will start to reap the rewards.

The value of collaboration

As a result of this opportunity, collaboration should be a focus to encourage innovation across the globe. To achieve this, banks need to overcome issues surrounding interoperability and a lack of industry standards. FS organisations must be equipped with the technology that allows them to introduce innovative solutions at speed.

A coreless banking approach, for example, empowers banks to select software vendors needed to obtain the best-of-breed for each application area without worrying about interoperability. Banks will also not be constrained to those service providers who operate within their technical language or messaging model because they will use one standard message model.

This ensures that each solution can seamlessly connect and exchange data, from FinTech’s to traditional banks to technology providers. It also means that organisations can communicate effectively on a global scale, removing barriers to growth and supporting international and national regulations, such as the Financial Services and Markets Bill.

An opportunity for growth

As digital adoption becomes more widespread, having access to the latest technologies that support consumers and banks alike is essential to the future of the industry. A more connected and seamless industry will undoubtedly deliver value, and although regulation is the foundation of the industry, collaboration and a consistent focus on the needs of every customer are the keys to unlocking the future.

Digital Banking: Making more of less money

The cost of living crisis that the United Kingdom has been reeling under since late last year is set to get worse, with the annual household energy bill predicted to touch £3,600 this winter. This will put enormous financial stress on families, 1.3 million families went into the pandemic with savings of less than a month’s income. How can banks help customers manage their money so that they save costs and earn better returns in these trying times? This article discusses some ideas.

by John Barber, Vice President, Infosys Finacle Europe and Ram Devanarayanan, Head of Business Consulting, Infosys Finacle Europe

Money management features to support budgeting and planning

The first thing banks can do is provide a tool that simplifies budgeting for the ordinary customer. A few mainstream U.K. banks already offer apps that not only group spending by category – food, utility, entertainment, travel, for example – but also allow users to set (and monitor) category-wise budgets.

For retail customers, some banks also support planning for future expenses by creating “savings pots” in which they can accumulate money towards a specific goal. For example, retail customers can save up for school fees, home renovation and emergency funds. Similar to savings pots, business customers can use virtual accounts to manage their money better. This enables them to use money efficiently and save on overdraft costs and earn higher returns through money market investments. Last but not least, virtual accounts also benefit banks by reducing the costs associated with creating new accounts.

Education for a long-term view

Knowing how the money was spent allows customers to take informed actions to manage their finances better. But tools can only do so much. To really improve the state of financial health, banks should join the government and academic institutions in building money management awareness among the general populace. A great example is LifeSkills, a Barclays initiative that has helped more than 13 million young people learn, among other things, money management skills such as budgeting and avoiding fraud. HSBC believes in informing them young by using storytelling and gaming to teach money concepts to kids right from the age of three. The truth is that only sustained education will teach people to plan finances for the long term. At a time when one protracted crisis is following another, the importance of financial planning cannot be overstated.

Banks can also leverage analytical insights to send contextual alerts nudging customers to pay bills on time, sweep excess funds into a higher-rate deposit and renew an insurance policy.

Open banking for control, convenience and choice

Having greater visibility and control helps customers make the best use of depleted resources. Open banking can play a role in this. For example, it enables Variable Recurring Payments (VRP), whereby customers can authorise payment providers to make payments on their behalf within agreed limits. Customers have greater flexibility over setting up/ switching off VRPs compared to Direct Debits and can also see the status of their VRPs on a dashboard.

Another advantage of open banking is better consent management – users can define clear parameters for what they are consenting to. This is also useful for small business customers to manage cash. For instance, a small business can use this facility to authorise AISPs (Account Information Service Providers) and PISPs (Payment Initiation Service Providers) to sweep excess liquidity into an external fund to earn a higher return.

Still, the adoption of open banking is quite limited in the U.K. Besides having data privacy and security concerns, customers don’t fully understand how open banking works and what it could do for them. Since most of these issues can be addressed through education, banks should include open banking awareness in their financial literacy programmes.

This would benefit them too. Open banking is an opportunity for financial institutions to tap ecosystem partnerships to present a more complete service, including non-banking offerings, to customers. They can source the latest, most innovative offerings from fintech companies to fulfil a variety of needs at competitive rates.

Personalised services at the right “moments in time”

At the very least, “correctly” personalised services – based on data analytics – prevent banks from annoying customers with irrelevant offers. But the real reason for personalising banking should be to deliver the right service at the right moment of time as a frictionless experience. This is also very much in the banks’ interest because it reduces the likelihood of customers fulfilling their requirements elsewhere.

Personalisation also builds banks’ customer understanding, crucial for a successful ecosystem play. The future belongs to banks offering competitive financial and non-financial propositions sourced in-house as well as from third-party ecosystem partners. India’s first fintech unicorn, Paytm, exemplifies this; it grew quickly from being a mobile wallet bill payment platform into a vibrant e-commerce marketplace before acquiring a banking license. In the first 18 months, Paytm Payments Bank opened a massive $42 million savings account.

In contrast, financial institutions persisting with the traditional banking model will be relegated to the role of a utility. To avoid that fate, they must invest in a robust digital platform capable of onboarding and supporting a diverse partner ecosystem.

Embedded, invisible banking

Ecosystem banking leads naturally to embedded finance, where banking products and services are inserted so seamlessly within customer journeys as to be almost invisible. Embedded finance fulfils the younger generations’ demand for an Amazon type of all-encompassing, personalised, frictionless and entirely digital experience that the next-generation providers are bringing to market. For example, Paytm offers a wide range of services, including banking, insurance and investments, ticket booking, food delivery, shopping, and of course, seamless payments to finance all of these.

To compete, banks will also need to compete with apps by increasing the capabilities of their apps beyond just core banking processes. All these evolutions – ecosystem play, platform business model, embedded finance, and app style capabilities – call for comprehensive digital transformation, starting from the banking core. DBS in Singapore is an outstanding example of a traditional financial institution that transformed itself into one of the world’s best digital banks. But even as other banks go on this digital journey, they should continue to create highly competitive products and services. This is especially important because in difficult times customers’ needs, above everything else, are more value for their money.