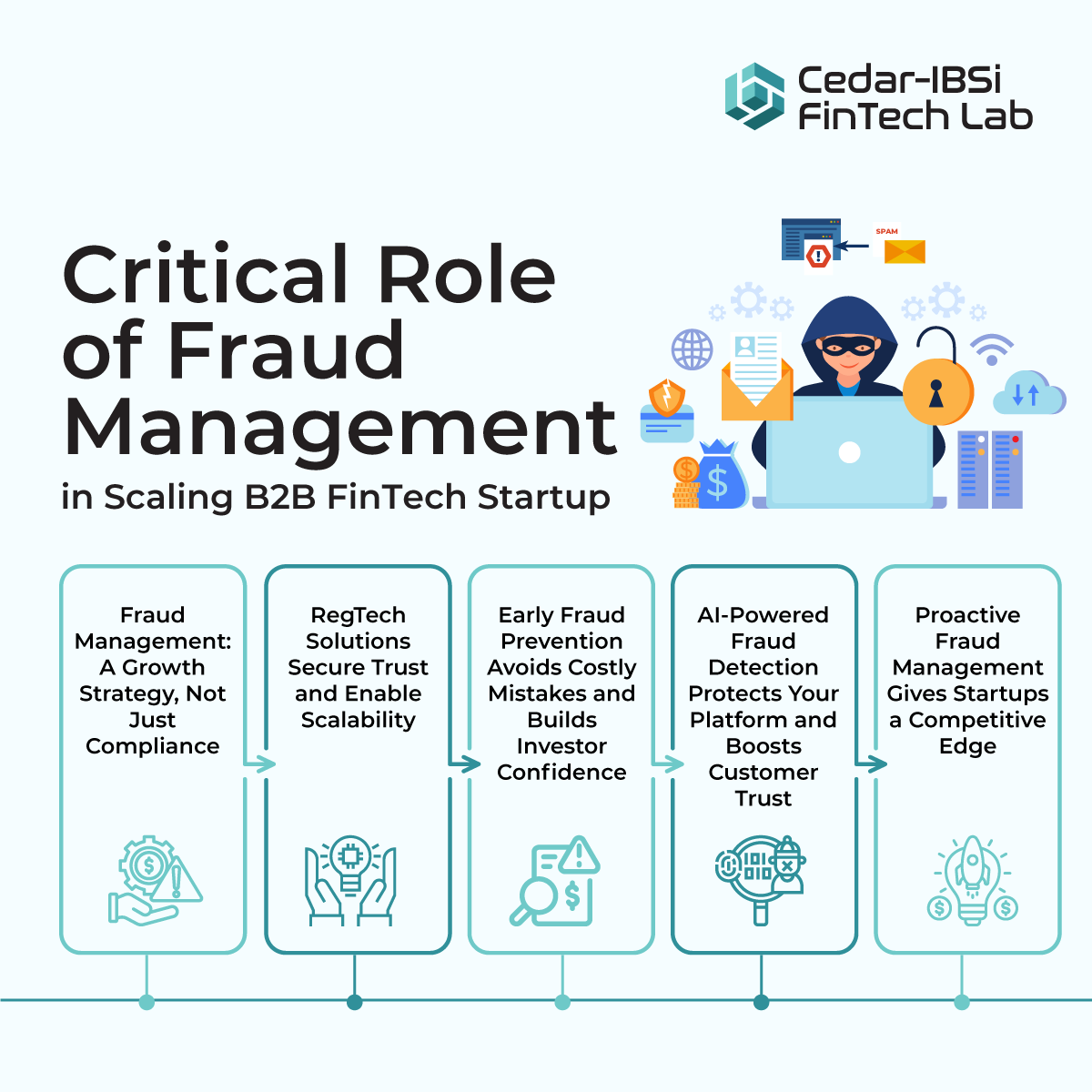

The Critical Role of Fraud Management in Scaling B2B FinTech Startups

October 16, 2024

In the fast-paced world of B2B FinTech, fraud management is not just a regulatory checkbox—it’s a cornerstone of sustainable growth and long-term success. Managing fraud is not just about compliance; you have to protect your business, customers, and reputation. For FinTech founders, especially those aiming to scale, addressing fraud early can save you from costly mistakes down the line. This blog underscores the paramount importance of integrating RegTech based fraud management solutions into B2B FinTech operations right from the outset.

As the volume of sensitive financial data and transactions handled by FinTechs increase, fraudsters too become more sophisticated. Without solid fraud prevention measures in place, a single breach can lead to significant financial losses, reputational damage, and loss of customer trust. These factors can be devastating for a young company. In the B2B space, where partnerships and trust are paramount, companies that fail to prevent fraud early on may struggle to secure long-term relationships or attract further investment.

Fraud management is a competitive advantage. Prioritizing robust fraud prevention strategies signals to your customers and investors that you take risk management seriously. This can set you apart in a crowded market.

B2B FinTech is also highly sensitive to disruptions. If your platform is seen as vulnerable to fraud, larger corporate clients will hesitate to trust you with their transactions. This is especially critical when dealing with financial institutions, enterprise-level clients, or international payments. By embedding fraud prevention into your core systems from day one, you are essentially future proofing your operations and showing clients and investors that you have a plan for scalability.

Enter RegTech; transforming how FinTech companies handle fraud detection and compliance. By using advanced technologies like AI and machine learning, RegTech can monitor real-time transactions, flag suspicious activities, and ensure ongoing compliance with global regulations. These automated tools reduce the complexity of regulatory frameworks, freeing up your team to focus on growth while also protecting your platform from bad actors.

Integrating RegTech solutions early equips you better to handle fraud and makes you more appealing to investors. Venture Capital (VC) companies are increasingly looking for startups that have these systems in place, as they reduce operational risk and demonstrate a clear path to scaling without regulatory hiccups. These startups also enjoy the perception of a low-risk investment with high potential returns, as a result of regulatory readiness and operational integrity.

Take, for example, B2B payment platforms that integrated RegTech-driven fraud management systems from the start. These startups not only managed to avoid costly breaches but also earned trust from enterprise clients, enabling faster onboarding and expansion. By focusing on fraud management from the beginning, they positioned themselves as reliable partners, which attracted additional funding and strategic partnerships.

Secure Pay Solutions, a startup offering B2B lending services that has prioritized fraud management, earned the trust of both clients and VCs. Their well-structured fraud prevention strategy became a key differentiator, helping them stand out in a crowded market and attract significant investment.

For B2B FinTech startups, integrating fraud management solutions from day one is first, a strategic imperative, and then a regulatory mandate. A robust fraud prevention framework can protect customer data, build investor confidence, and drive growth. Startups that recognize and act on this insight are better prepared to thrive in the competitive FinTech landscape and build themselves a secure and scalable future.