Modern Core Banking: Build, Buy, or Partner?

May 14, 2025

In today’s rapidly evolving financial landscape, banks face a critical decision on how to modernize their core banking systems. Core systems are the backbone of financial institutions, connecting payments, customer data, and embedded services. As customer expectations rise for faster, personalized, and seamless services, upgrading core systems has become imperative. Banks must choose between three key strategies: building in-house, buying off-the-shelf solutions, or partnering with FinTech firms. Each option offers distinct advantages but requires careful consideration to future-proof the bank’s technology infrastructure.

A significant barrier to core banking transformation is the fear of change. Banks are often comfortable with their legacy systems, even if outdated, making the transition to newer technologies difficult. However, operational resiliency and the growing “tsunami of regulations”—such as AI regulations—are strong drivers for transformation. Banks must move beyond merely improving existing systems and focus on “leapfrogging” their technology as discussed with a senior Banker at the Next Gen Core Banking Cedar IBSi Summit held in London. Rather than incremental upgrades, transformation should address regulatory challenges and aim for innovation while enhancing both customer and staff experiences.

Building an in-house core banking system offers maximum customization. Banks can design systems tailored to their specific needs, aligning with operational models, customer segments, and long-term goals. This level of control allows better integration with existing systems and internal processes. However, the cost of developing a custom solution is significant—often exceeding $50 million—and can take years to implement. Additionally, the ongoing costs of maintenance, system updates, and staffing can hinder a bank’s ability to remain agile in responding to market changes. This option is more suitable for larger banks with substantial resources.

Buying off-the-shelf solutions from established vendors such as Temenos, Fiserv, or FIS is a popular approach for banks seeking quick implementation and stability. These systems come pre-configured, ensuring compliance with local and global regulations and offering rigorous testing for reliability and security. The key advantage of buying is speed—solutions can often be deployed within 6 to 12 months, allowing banks to modernize quickly and reduce operational risks associated with outdated systems.

However, off-the-shelf systems often lack flexibility. Banks may need to adapt their business processes to fit the technology, which can restrict operational agility. Over time, dependency on the vendor for updates and troubleshooting can lead to vendor lock-in, making it difficult and costly to switch providers.

Partnering with FinTech firms and adopting Banking-as-a-Service (BaaS) models are innovative ways for banks to modernize core banking without building or buying a new system. Both approaches allow banks to integrate advanced technologies like real-time payments, AI-powered analytics, and open banking APIs.

- Partnering with FinTech Firms: Through partnerships, banks gain access to cutting-edge services while avoiding the high costs of building or buying a full core system. However, banks must carefully vet FinTechs, especially newer players, for data security and regulatory compliance. Partnerships also require effective management to ensure alignment with the bank’s strategic goals.

- Banking-as-a-Service (BaaS): BaaS enables banks to offer new services without developing all the infrastructure. This model is cost-efficient and reduces time-to-market, allowing banks to launch new products quickly. However, BaaS requires careful oversight to ensure regulatory compliance and alignment with business objectives.

As the financial ecosystem evolves, banks must focus on future-proofing their core banking systems. Flexibility is the cornerstone of modern core banking, enabling institutions to adapt to future technologies and customer demands. Open finance, blockchain and digital assets are key areas for banks to monitor as they represent the next wave of banking innovation.

A hybrid multiload strategy is essential for avoiding dependence on a single hyperscale. This approach ensures operational resilience and flexibility, allowing banks to distribute workloads across various platforms for optimized performance and security.

Next-gen core banking systems must be modular and flexible, enabling banks to deploy new technologies quickly. A distributed, event-driven architecture is critical for scalability, although it brings operational complexity. Banks should have the freedom to choose where and how they run their software, supporting diverse deployment models.

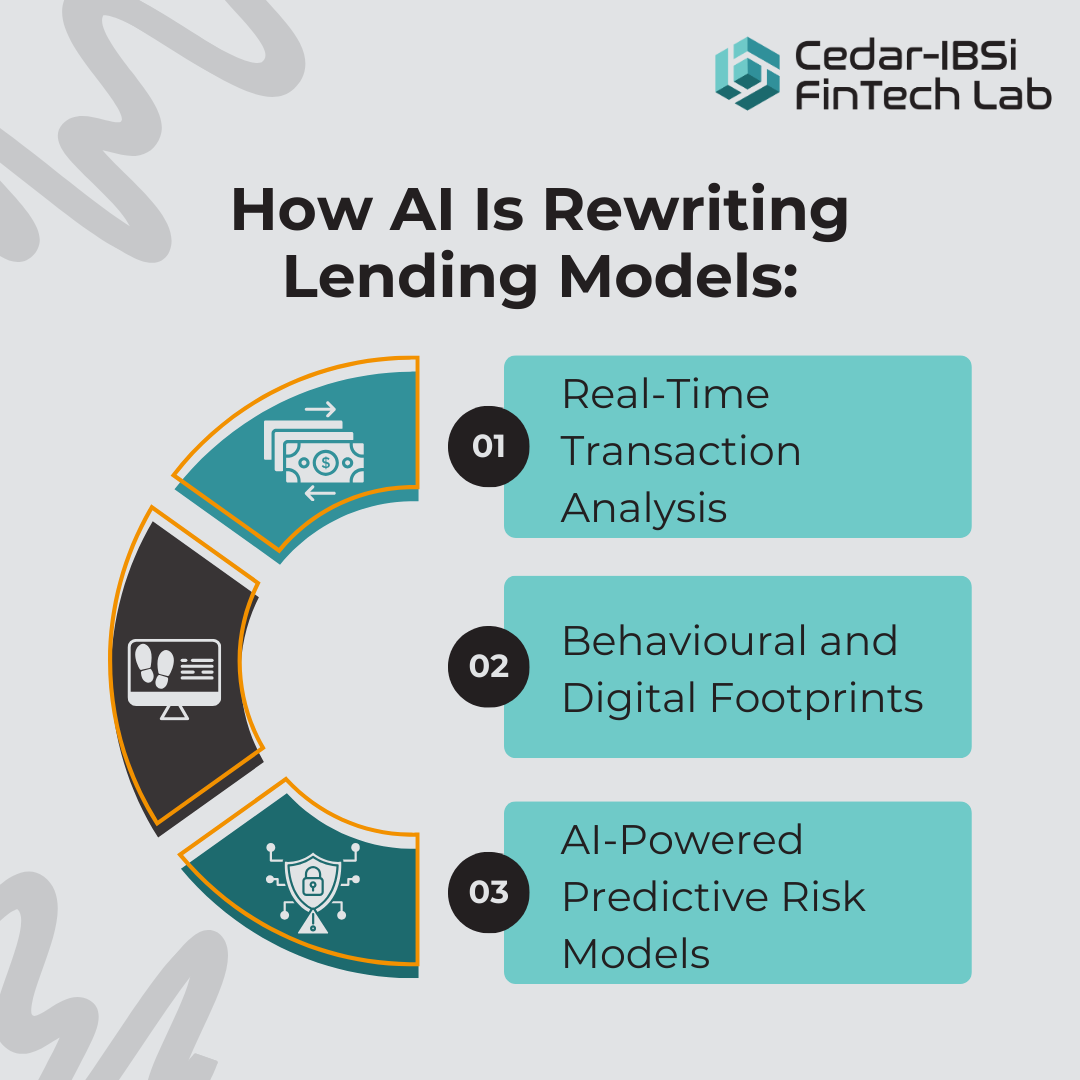

Emerging Technologies: AI, Open Finance, and Quantum Computing

- AI: Human-centric AI is crucial in banking, as decisions made by AI systems affect significant aspects of customers’ lives. Ensuring that AI is transparent and designed with customer well-being in mind is key.

- Open Finance: Open finance is the evolution beyond open banking, enabling greater customer-centric solutions through data-sharing platforms.

- Quantum Computing: While still emerging, quantum computing offers the potential to revolutionize areas like data processing, risk analysis, and cryptography in banking.

The choice between building, buying, or partnering to modernize core banking systems is complex and depends on a bank’s size, resources, and strategic goals. Building in-house offers control but comes with high costs and long timelines. Buying provides speed and stability but lacks flexibility. Partnering and BaaS offer agility and innovation but require careful management of third-party relationships.

Banks must carefully evaluate their options and focus on flexibility, scalability, and regulatory compliance to ensure that their core banking systems are prepared for the future. By aligning their choices with long-term goals, banks can stay competitive in an increasingly digital world.