Unleashing FinTech’s Soaring Potential: 2024 and beyond

January 16, 2024

The future of FinTech in India in 2024 and beyond will be characterized by deeper financial inclusion, innovative solutions, increased digitization, and greater accessibility to financial services for all. Technology, especially smartphones, will be a driving force in connecting a more extensive customer base with a wide array of financial products and services, ultimately improving the overall financial well-being of individuals and businesses across the country.

Cedar-IBSi FinTech Lab and Cedar-IBSi Capital (SEBI AIF), with Cedar-IBSi’s in-house 500+ years of cumulative experience in advancing FinTechs and banks are poised to play a pivotal role in fostering an environment conducive to growth, collaboration, and cutting-edge financial technology solutions. At the recent Cedar-IBSi FinTech Happy Hour, there was unanimous agreement that financial technology will persist in its expansion, delving deeper into tier 2 and tier 3 cities. This expansion is foreseen to unveil more significant business opportunities driven by technological advancements and the omnipresence of smartphones. As a result, FinTech is strategically positioned to tap into a broader customer base in these cities.

G Aswin, VP – Strategy Innovation at Protean, emphasized the role of emerging technologies in reinforcing India’s FinTech ecosystem, “As we progress beyond traditional AI, we are venturing into neural networks, particularly for post-trade operations. Once considered cutting-edge, Robotic Process Automation (RPA) has become outdated due to its high initial investment, ongoing maintenance, and service requirements. In contrast, neural networks are gaining traction alongside blockchain technology. It’s crucial to create awareness about the advantages of blockchain technology in India, especially as foreign governments are embracing it enthusiastically.”

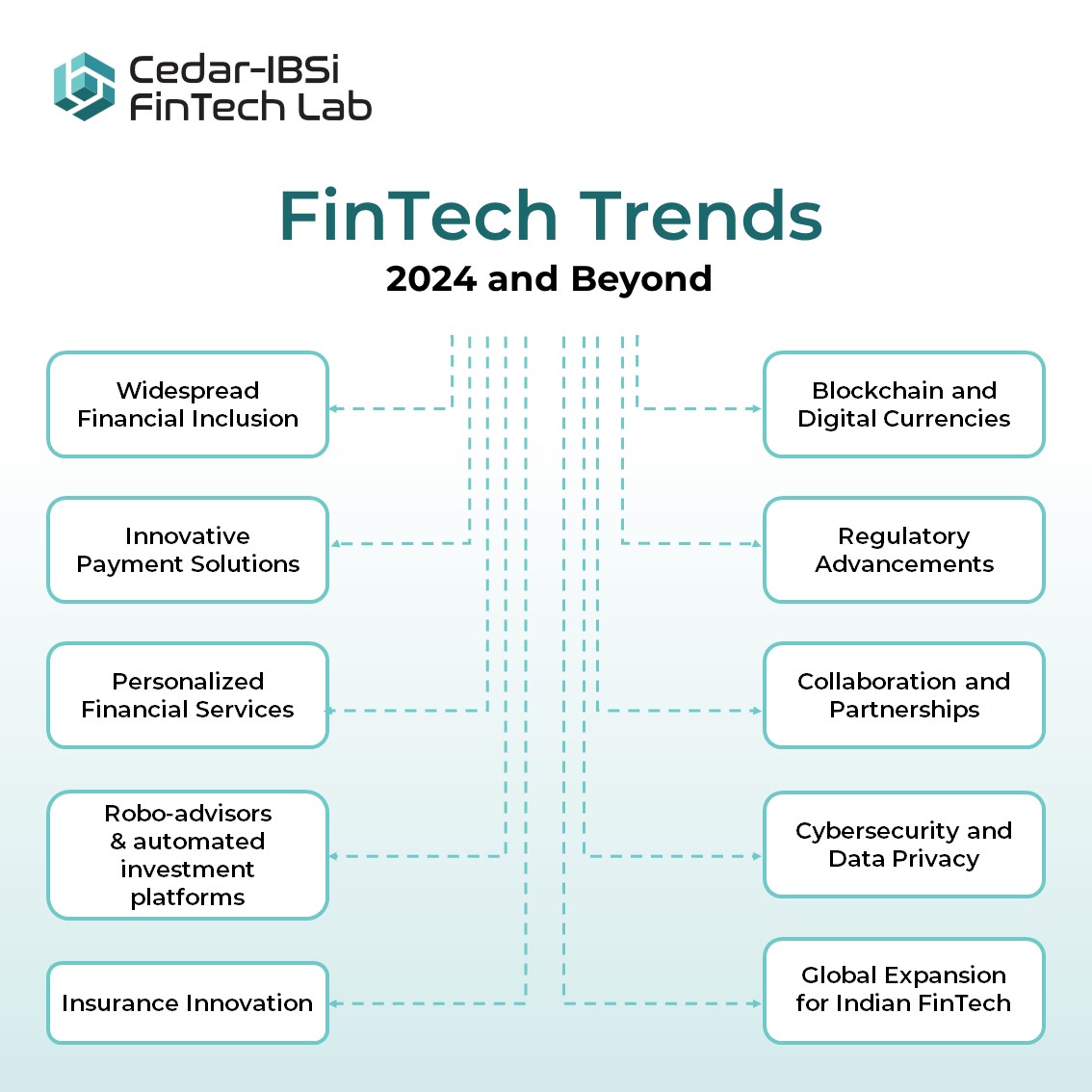

Reflecting on the strides made in 2023, where partnerships flourished, fostering collaborative innovation, we now focus on the horizon of 2024. Anticipating the trends that will shape the FinTech landscape, let’s preview what lies ahead in the ever-evolving intersection of finance and technology.

Here’s a glimpse of what FinTech will look like in 2024 and beyond:

- Widespread Financial Inclusion: FinTech will play a pivotal role in bringing financial services to previously underserved populations in India, particularly in tier 2 and tier 3 cities. With the help of smartphones, mobile banking, and digital wallets, people in remote areas have improved access to banking, payments, and credit services.

- Innovative Payment Solutions: Cashless transactions will become more prevalent, and new payment methods will emerge. This may include seamless peer-to-peer payments, digital currency adoption, and contactless payments. Customers can expect faster, safer, and more convenient payment options.

- Personalized Financial Services: FinTech companies will leverage data analytics and AI to provide highly personalized financial solutions. Customers will receive tailored advice and products based on their financial goals, risk tolerance, and spending patterns.

- Wealth Management for All: Robo-advisors and automated investment platforms will continue to grow, making it easier for people to invest and manage their wealth. This will not be limited to the affluent but extend to the broader population.

- Insurance Innovation: Insurtech will revolutionize the insurance industry. FinTech will offer on-demand, pay-as-you-go insurance, using data from various sources to provide more accurate risk assessments. Claim processing will be expedited, making insurance more accessible and efficient.

- Blockchain and Digital Currencies: Cryptocurrencies and blockchain technology will continue to gain momentum. They will not only serve as alternative investments but may also find applications in cross-border remittances and settlements. Central bank digital currencies (CBDCs) may also make their debut.

- Regulatory Advancements: Regulatory bodies will adapt to the changing landscape. There may be more comprehensive guidelines for FinTech companies, including those involved in lending and payment processing. Regulatory sandboxes will continue to encourage innovation while ensuring consumer protection.

- Collaboration and Partnerships: Traditional financial institutions will increasingly partner with FinTech companies to offer a broader range of services and enhance their digital capabilities. This synergy will result in a more comprehensive and seamless customer experience.

- Cybersecurity and Data Privacy: With the increasing reliance on digital financial services, cybersecurity will be a top priority. FinTech companies will invest heavily in protecting customer data and transactions, and regulations around data privacy will continue to evolve.

- Global Expansion for Indian FinTech: FinTech firms in India will look beyond domestic markets, expanding into international markets and collaborating with global players. This globalization will provide opportunities for Indian FinTech firms and contribute to India’s status as a FinTech hub.

The future of FinTech in 2024 and beyond is poised for significant growth and transformation, driven by a confluence of technological advancements, changing consumer behavior, and regulatory developments.

10 Reasons why your FinTech Needs the Transformative Power of Labs & Incubators

December 4, 2023

During the recent FinTech Happy Hour, hosted by Cedar-IBSi FinTech Lab and Cedar-IBSi Capital (SEBI AIF), founders, investors, and CXO executives from FinTech, BankTech, and BFSI institutions, came together to exchange ideas, network, and collaborate on Everything FinTech!

One topic that echoed in the room was the importance of labs and incubators in India and the role they can play for FinTech companies.

In the rapidly changing FinTech landscape, the demand for guidance, mentorship, and strategic connections is essential. The Cedar-IBSi FinTech Lab is one such powerful catalyst driving these ideas towards unrivalled success since 2018 when it was set up in Dubai’s Internet City. The Lab not only cultivates invaluable mentorship but also forges highly lucrative connections within the FinTech industry.

Talking about the potential of labs and incubators, Geeta Chauhan, Co-founder, and CEO, HiWi noted, “Incubation and lab programs are particularly useful for startups with no experience or who are starting from scratch. FinTech(s) can take advantage of mentorship programs, a set of contacts and funding that ensure they get the right foot in the door.”

Here’s how labs and incubators are revolutionizing FinTech in India.

- Mentorship and Guidance: Labs and incubators provide access to experienced mentors and industry experts who can offer valuable guidance and insights. This mentorship can help FinTech startups make informed decisions and navigate the complexities of the financial industry.

- Validation and Credibility: Being a part of an established incubator or accelerator program can add credibility to a FinTech startup. It validates the business idea and can make it easier to gain trust from potential partners, customers, and investors.

- Networking Opportunities: Accelerator programs like the Lab offer an extensive network of contacts in the FinTech and financial services sectors. Startups can connect with potential customers, partners, and investors, which is essential for growth and success in the FinTech industry.

- Product Development Support: Many FinTech startups need technical assistance and support for product development. Incubators, such as the Cedar-IBSi FinTech Lab can offer access to development teams, resources, and infrastructure to help in building and refining products.

- Market Research and Validation: Incubation programs often provide access to market research data and opportunities for market validation, enabling FinTech startups to fine-tune their offerings to meet customer needs.

- Fundraising Opportunities: Incubators and accelerators can introduce FinTech startups to potential investors, refine their pitch and business model, making them more attractive to investors. Many incubators and accelerators provide direct funding to early-stage startups in the form of grants, equity investments, or loans.

- Cost Savings: Shared office space, resources, and infrastructure can significantly reduce the operational costs for startups, allowing them to focus their financial resources on product development and growth.

- Skill Enhancement: These programs often offer training sessions and workshops that help FinTech entrepreneurs, and their teams enhance their skills in various areas, including marketing, sales, and leadership.

- Risk Mitigation: By providing a supportive ecosystem, labs and incubators can help FinTech startups identify and mitigate risks early in their development, improving their chances of long-term success.

- Market Entry Assistance: For FinTech startups, entering the Indian market can be challenging due to the diverse customer base and regulatory environment. Incubators can provide market entry strategies and assistance.

The Cedar-IBSi FinTech Lab is a dynamic entity propelling FinTech companies towards their target market. It has a proven track record in assisting 35+ FinTechs since 2018, offering market access and collaboration; product and market intelligence via the Cedar-IBSi Platform; visibility via exclusive in-house, global events, leadership interviews, coverage via the IBSi Podcasts and in the IBSi FinTech Journal; Acceleration and access to interesting co-investment opportunities via Cedar-IBSi Capital (SEBI AIF).

For FinTechs in the Middle East & India, the Cedar-IBSi FinTech Lab is not just a place for mentorship: it’s a hub. A hub that fosters a culture of creativity, facilitating FinTech startups to think outside the box and develop groundbreaking solutions.

Labs & incubators are thus the perfect partners in your FinTech journey to realize the true power of transformation, innovation, growth, and limitless possibilities.

Transforming financial lnclusion through AI and Machine Learning

The financial industry is undergoing a profound transformation, largely driven by the growing influence of Artificial Intelligence (AI) and Machine Learning (ML). Within this dynamic landscape, the FinTech sector has emerged as a trendsetter, spearheading the adoption of AI and ML technologies.

By Rajat Dayal, CEO, Yabx

These advancements are redefining sustainable finance, particularly in terms of financial inclusion, by breaking down barriers that have traditionally hindered access to banking services, such as loans and investment opportunities for the unbanked population.

Credit Scoring and Risk Assessment

Yabx’s innovative use of AI/ML algorithms on raw data has led to the creation of 15,000 features for comprehensive financial profiles of borrowers, highlighting their commitment to data-driven lending. This transformation is pivotal, with credit scoring and risk assessment at its core. These systems leverage a diverse range of data to assess an individual’s financial reliability, effectively reducing one of the key risks associated with lending. Machine learning models have elevated the standards of evaluating an individual’s creditworthiness. This innovative approach empowers banks to expand their portfolios without compromising their risk tolerance, offering loans with a more refined risk management strategy.

Recommendation Engines

In a world where choice is paramount, AI-driven recommendation engines come to the forefront. These engines utilise customer behaviour patterns to provide tailored suggestions for financial products and services, especially loan products that align with the unique needs of each consumer. This bespoke process significantly increases the likelihood of successful loan applications, offering a more personalised and user-friendly experience.

Enhancing Customer Segmentation and Personalisation

AI and ML algorithms are now increasingly employed to enhance customer segmentation and personalisation. The ability to categorise consumers based on their financial behaviours and preferences allows for the provision of tailored loan products with unparalleled precision. This level of personalisation is particularly valuable for microbusiness owners, as it reduces the traditional financial bureaucracy, making borrowing more accessible.

Customer Insights and Market Research

AI and ML technologies offer analytical power, enabling organisations to gain deep insights into market trends and customer behaviour. This foresight equips businesses with the ability to adapt to market shifts and cater to the evolving financial needs of their diverse customer base, ensuring they remain competitive.

Automated Customer Onboarding

Efficiency and customer accessibility are at the forefront of the FinTech process. AI-driven solutions automate identity verification and Know Your Customer (KYC) procedures, streamlining the customer onboarding process. This automation ensures that borrowers can promptly access the financial support they need, free from cumbersome administrative delays.

In Action

An exciting example of AI and ML in action is Zed-Fin Loans, powered by Yabx, a pioneering sustainable banking initiative in Zambia driven by a powerful tri-party LAAS partnership. This partnership allows parties from three adjacent industries to work together to bring micro loans to the market in Zambia. Zed-Fin Loans is a testament to the transformative power of collaboration, technology, and innovation. Their success is a resounding endorsement of AI and ML algorithms, displaying their positive impact on Zambia’s financial landscape.

In conclusion, AI and ML are revolutionising the financial sector, making it more inclusive, efficient, and customer centric. These technologies are breaking down barriers and setting new standards, as demonstrated by the success of initiatives like Zed-Fin Loans in Zambia. The future of finance in Zambia and around the world looks to be very promising, thanks to the collaborative power of technology and innovation.

What’s next in digital transformation in Europe

In Broadridge’s third annual Digital Transformation and Next-Gen Technology Study, 500 C-level executives and their direct reports across the buy side and sell side from 18 countries were surveyed

Mike Sleightholme, President, Broadridge International

On average, respondents’ firms control estimated assets of $121 billion. More than half agreed that digital transformation is currently the most important strategic initiative for their company, and the proportion of IT budgets allocated to digital transformation has increased to 27% on average, up from 11% last year. A further 71% of global respondents also say AI is now significantly changing the way they work.

The biggest increase in technology investment from European firms in the next 2 years will be allocated to cybersecurity – with respondents saying they plan to increase spending by 29% by 2025. This level of backing is followed closely by investments into cloud platforms and applications. Firms are ‘lifting and shifting’ legacy systems in favour of cost-effective, cloud-based infrastructure with microservices and APIs at the core.

Spending on data analysis and visualisation tools is planned to increase by 26% in the next 2 years. As it stands, too many firms are relying on fragmented data sets that could offer valuable insights if they were brought together and combined with powerful analytics solutions. The top driver for these investments is improved customer acquisition and retention. As market competition increases, the benefits that next-gen technologies can bring to the end-consumer are one of the most significant ways that firms may differentiate themselves from one another.

The second biggest factor in the decision-making process are cost savings and efficiencies. As next-gen technologies mature, the financial benefits become more tangible, making it easier to define a business case for investment.

Finally, speeding up the time it takes to bring new products to market is a priority for European firms and ranks as the third biggest driver for investments. This agility allows firms to take advantage of short-lived opportunities to gain market share in new asset classes or client segments as the pace of change accelerates.

The biggest challenge cited by European firms is insufficient budget for innovation. Particularly against today’s economic backdrop, firms are feeling hesitant to invest money into new projects. The second biggest challenge is staff resistance to constant change. Gaining buy-in from the teams that will be using the technology can be as important as buy-in from the C-suite approving investments. Education is important – firms must ensure their teams properly understand why these technologies are necessary, the efficiencies they can create, and how they will help the team, the business, and clients. The third most prevalent challenge for European firms is ongoing market and economic disruption. Against a backdrop of geopolitical tensions, recession fears and persistent inflation, it can be difficult for business leaders to focus their attention on technology investments.

Digital transformation is still at the top of the C-suite agenda, but it is also entering a new phase driven by more powerful technology. Widescale adoption of generative AI, as well as growing maturity in blockchain and DLT, will drive a new wave of exponential change. Other nascent technologies such as quantum computing and the metaverse are on the horizon.

When asked about the longer-term future, 65% of European firms believe that blockchain and DLT will become the core of financial markets infrastructure in 10 years’ time. Nearly a third believe that the metaverse will become a key channel for client interaction within the next 10 years. However, firms said they only plan to increase investment in the metaverse by 4% over the next 2 years, indicating a wait and see approach.

This is an exciting time for the financial services industry, adapting to the rapid pace of change may pose huge challenges for business and society, senior leaders should keep a firm eye on the opportunities created by digital and next-gen technologies as they evolve.